Tariff Resource Center

Curated resources designed to help you navigate the changing trade landscape.

FEATURED CONTENT

Tariff Codes: What You Need to Know

This article breaks down what tariffs and tariff codes are, the different types that exist, and how to read them.

Recommended Articles

All About Onshoring

Learn about onshoring and why many manufacturers are rethinking how and where they operate.

Trump Announces 100% Semiconductor Tariff

President Trump has announced a sweeping 100% tariff on semiconductor imports, but it won’t apply to companies like Apple that are expanding their manufacturing footprint.

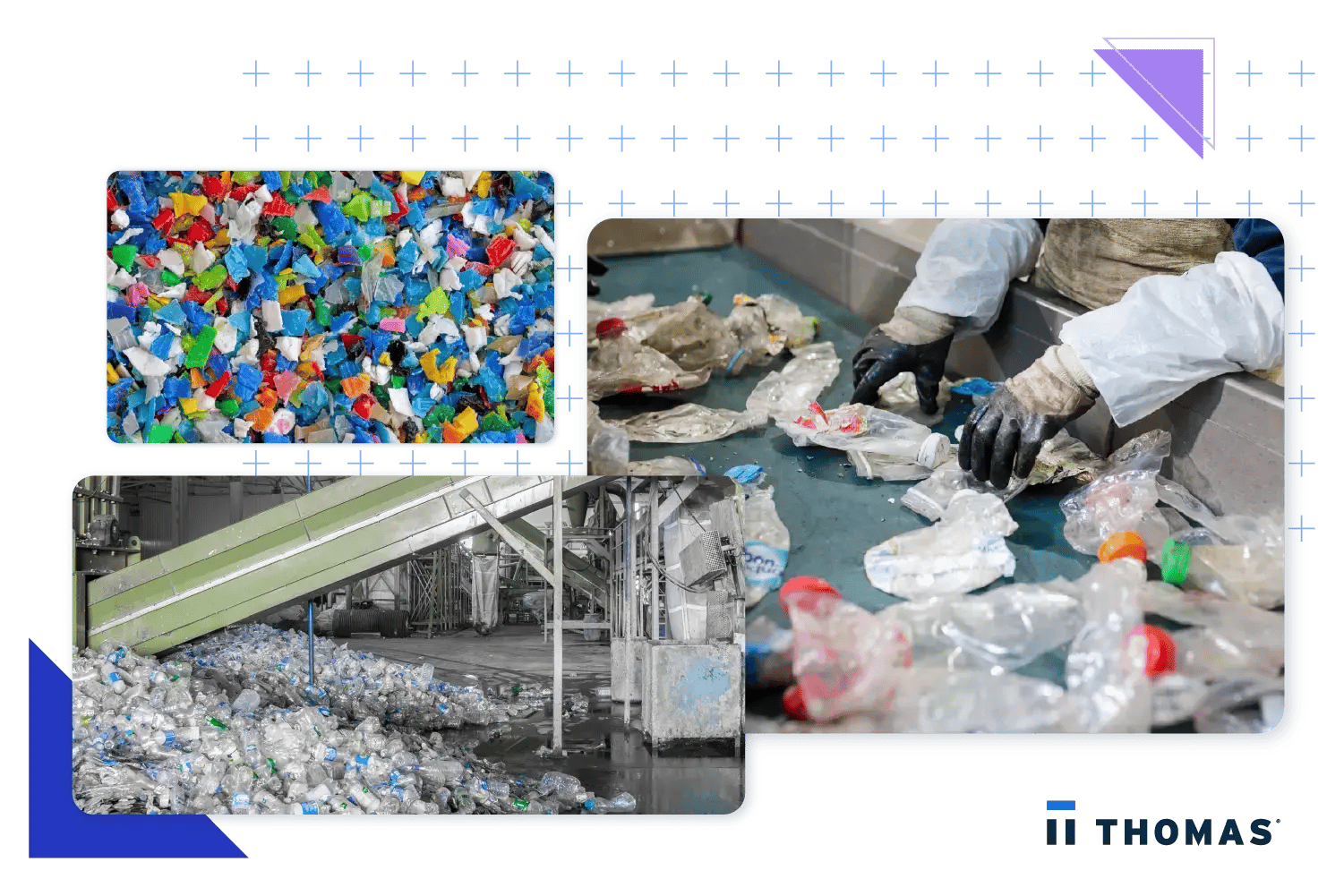

Plastic Recycling Services Industry Overview

Understand sourcing trends in the plastic recycling services industry and find frequently sourced suppliers.

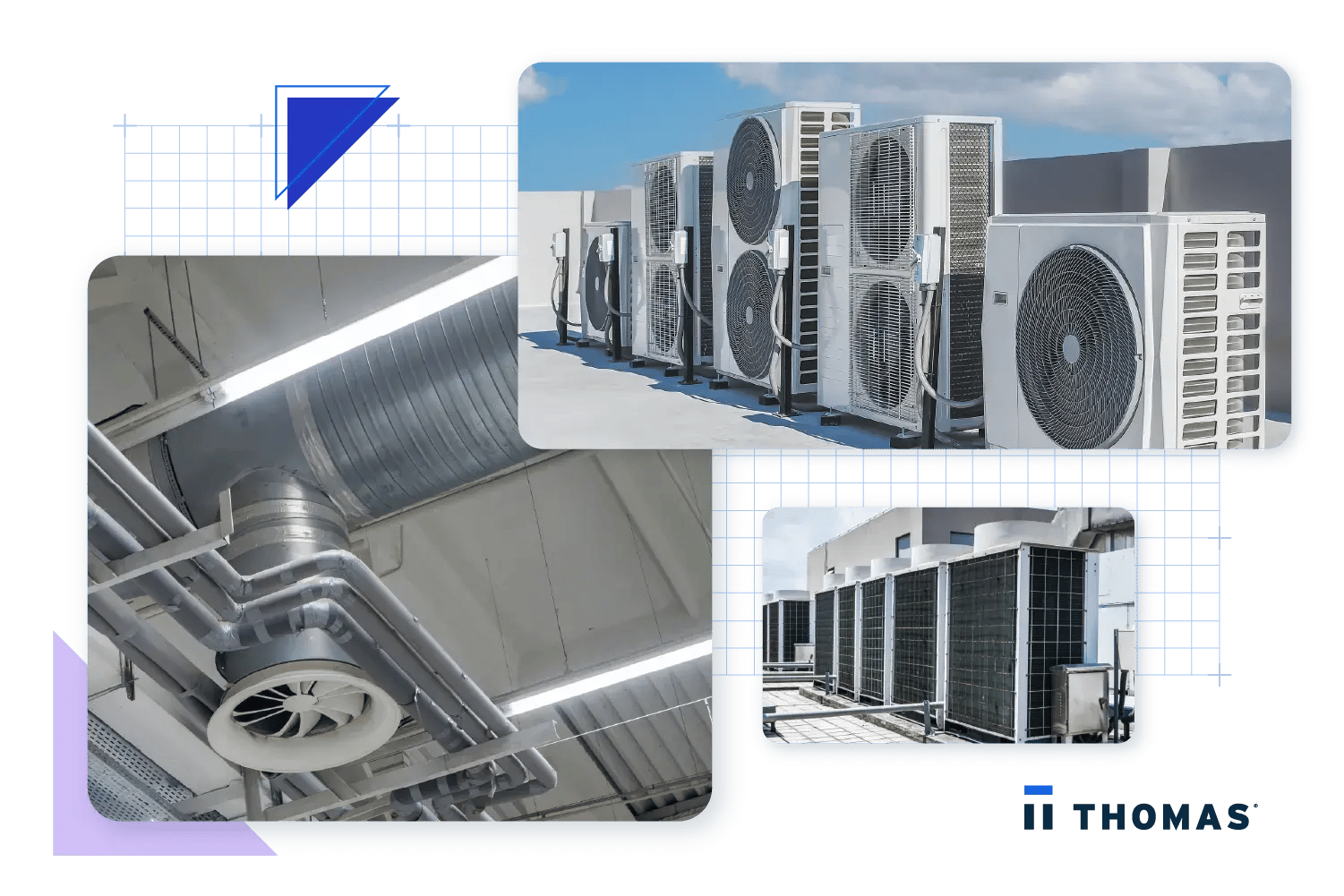

HVAC Systems Industry Overview

Get a snapshot of the HVAC Systems sourcing landscape, plus the top suppliers on Thomasnet.

Tariff FAQs for Industrial Buyers

A tariff is a tax on imported goods, usually imposed to protect domestic industries or raise revenue. Duties are specific types of tariffs and can also apply to exports or specialized goods.

Tariffs can raise the cost of materials or products imported into the U.S., which may be passed along to buyers in the form of higher prices, especially for overseas suppliers.

Diversifying your supplier base, sourcing domestically where possible, and building relationships with multiple vendors can help minimize disruption from shifting trade policies.

Yes, Thomasnet lets you filter by location, certifications (like ISO or ITAR), and diversity status so you can find the right fit for your sourcing strategy.

You can subscribe to the Thomas Industry Update daily newsletter or check back here for regularly updated content on trade developments.

More Resources to Help You Source Smarter

Get Found By Buyers & Engineers

Connect with the most active and qualified network of B2B buyers on the world's leading platform for product discovery and supplier selection.